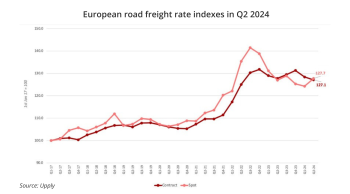

The Upply x Ti x IRU European road freight rates index shows that Q2 rates fell in the contract index by 1.3 points quarter on quarter (q-o-q). In contrast, the spot rate index rose by 3.5 points q-o-q. Year on year (y-o-y), the spot index is now up slightly by 0.8 points, while the contract index is down 0.7 points.

- The Q2 2024 European Road Freight Spot Rate Benchmark Index rose to 127.7 points, 3.5 points higher than in Q1 2024 and 0.8 points up y-o-y.

- The Q2 2024 European Road Freight Contract Rate Benchmark Index fell to 127.1, 1.3 points lower than in Q1 2024 and 0.7 points lower than in Q2 2023.

- According to IRU’s preliminary 2024 driver shortage results, 48% of European companies expect to face more difficulties filling truck driver positions next year.

- The European Commission issued a formal notice to 16 EU countries to move towards the implementation of the Eurovignette Directive.

- Diesel prices fell throughout the quarter until early June when they began to rise again. But by the end of June, prices were still 5% lower than in the beginning of April.

- The outlook for spot rates across Europe suggests moderate increases as we’ve entered a more stable demand environment in 2024.

- The outlook for contract rates remains subdued as industrial output is still low, restraining contract rate growth.

Low levels of consumer demand have pushed down spot rates since Q2 2023. However, spot rates have begun to normalise, as the demand environment is now less negative. Adjusted retail sales, excluding motor vehicles in the euro area, have improved only marginally q-o-q (0.3%). The increase was similar y-o-y (0.4%).

In the EU, industrial production saw a 1% decrease for intermediate goods and a 2.1% decline for durable consumer goods in May 2024 compared to the previous month. Non-durable consumer goods rose by 0.8%. The lack of industrial demand contributed to the contract index dropping by 1.3 points q-o-q.

Operating costs have increased q-o-q, especially for labour, maintenance and insurance. Average costs have risen across the board, with the average growth being 1.2% for the EU. Most notably, labour and vehicle insurance costs have increased by 1.2% and 3%, respectively. However, the increases are not as steep as in the last quarter, when labour costs increased 1.8% and spares rose 1.1%. We can therefore observe the effects of supply-side pressure easing on both spot and contract rates.

Diesel prices fell between April and June, driven by declining crude oil prices. The EU weighted average diesel price reached EUR 1.07 per litre on 10 June, down from EUR 1.20 per litre on 8 April (-11%), the lowest level since summer 2023. Diesel prices have increased since, pushed up by rising crude oil prices, with the EU weighted average diesel price reaching EUR 1.14 per litre on 8 July (+6.4% versus 10 June).

Ti Head of Commercial Development Michael Clover said, “Though the pace of road freight cost increases has slowed, notably falling in terms of fuel, we still expect to see costs rising for the year ahead. With volumes returning and capacity tightening again, we expect to see carriers be more successful in passing on cost increases to their customers. In that sense, we are expecting market conditions to return to their long-term trend of gradual increases in line with costs for the remainder of 2024.”

Upply Chief Executive Officer Thomas Larrieu commented, “The road transport sector continues to evolve in a complex economic landscape. Our data for the second quarter of 2024 shows a slight increase in spot rates, contrasting with a modest fall in contract rates. Despite persistently high operating costs, the first signs of stabilisation in consumer demand are beginning to appear. Lower fuel prices and improving consumer confidence offer a positive outlook. Market conditions should gradually improve as the year progresses.”

Ti expects that spot rate increases will continue to be incremental as consumers are still cautious and households remain in saving mode, unless there is a significant wage increase, which will be reflected in consumer demand in the longer term. Ti’s outlook for contract rates suggests that they will remain relatively low as long as the recovery in industrial output remains sluggish. The contract rates index might continue to decrease slightly until there is a resurgence in new order demand, fuelled by inventory replenishment. With upcoming contract renewals, companies will demand less volumes for road freight, freeing up capacity and reducing upwards pressure on contract rates.

According to IRU’s preliminary 2024 driver shortage results, 48% of European companies expect to face more difficulties filling truck driver positions next year. Over one third of truck drivers are 55 years old or older and will retire in the next ten years, while only 5% are under 25. Additionally, road freight demand is expected to improve in 2025. Without significant action to improve the attractiveness of the profession and/or increase driver productivity, such as by allowing the use of longer and heavier trucks, the truck driver demographic gap will grow in the coming years and potentially put upward pressure on driver costs.

In a further development in toll taxes across the European market, Sweden has shared its plan for the introduction of its tolling scheme’s CO₂ component. A new CO₂ component will be added in January 2025 for vehicles with a gross combination weight exceeding 12 tonnes, which will be extended to all vehicles by end of March 2027. The toll increase is said to be limited at first, but there are no clear figures yet.

Denmark and the Netherlands will follow suit in 2025 and 2026, respectively. In May 2024, sixteen EU countries (Belgium, Bulgaria, Croatia, Cyprus, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Poland, Portugal, Slovenia, Slovakia and Spain) received a formal notice from the European Commission to advance with the implementation of the Eurovignette Directive. Changes might therefore come sooner than expected for these countries.

Additionally, three countries have announced changes to their toll fees which are not related to the Eurovignette Directive. Toll fees for heavy-duty vehicles have increased by 6.8% in Slovenia since mid-July 2024. Fees have also increased in Belgium since July, following an adjustment for inflation (electric and hydrogen trucks are exempted in Flanders and Brussels but not in Wallonia). Hungary will implement a similar correction in January 2025.

IRU Senior Director for Strategy and Development Vincent Erard added, “Road transport companies, key drivers of economic growth, are facing the dual pressing challenge of meeting demand for transport services amid soaring costs – fuel prices are projected to increase, labour costs are on the rise, and now we also have the new CO₂ tolls – while also decarbonising. This is likely to increase freight rates, as growing demand for transport services is putting pressure on the available capacity. With much of the sector consisting of small and medium-sized enterprises, operators have razor-thin margins. Policymakers must support operators and the sector to meet demand, including by quickly investing in both efficiency measures – for vehicles, drivers and the wider logistics system – and alternative fuels implementation. This would serve our planet and economy.”