Road freight operators are spending more on wages, equipment and services. This article, based on the latest IRU Intelligence Briefing, breaks down their investments and costs.

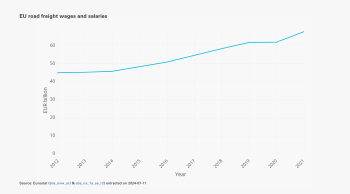

Total wages (salaries, bonuses and allowances included) in road freight have risen by approximately 49% over the past decade.

This significant increase is a combination of a 27% growth in the number of people working in the sector and a rise in salaries.

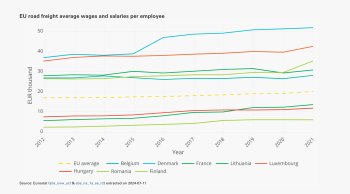

On average, EU road freight salaries rose by 18% between 2013 (EUR 16,940) and 2021 (EUR 20,130). As expected, salaries vary significantly among EU countries (breakdown per EU country available in briefing).

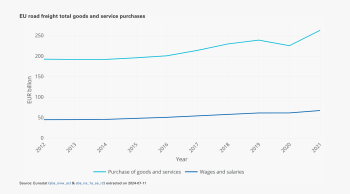

The increase in spending on assets (such as vehicles) and services have been less pronounced than that of wages (37% and 49%, respectively).

On average, road freight company spending on assets, services and wages rose by 40% over the past decade.

At the national level, road freight operators in Belgium, Denmark, Luxembourg and the Netherlands lead in investments (national breakdown available in briefing).

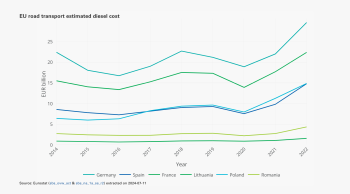

Energy costs have also risen, impacting both passenger and freight road transport. Diesel expenditure have generally increased in all countries over the past decade, with occasional declines such as during the pandemic.

Diesel expenditure is expected to continue rising due to the war in Ukraine’s impact on the energy market.

Together, wages and salaries (around 35%), investments in equipment (around 28%) and energy (around 24%) make up 87% of road freight companies' costs.

This IRU Intelligence Briefing on the macroeconomics of the EU road transport sector focuses on demographic trends, economic performance, costs and external economic factors, tackling questions such as:

- How many people work in the EU bus and truck sectors? What are their average salaries?

- Which country has the biggest workforce?

- Does the size of a country’s workforce reflect its volume of goods?

- How many road transport companies are there in the EU?

- What is the economic contribution of large road transport companies? What about SMEs?