IRU member the American Trucking Associations (ATA) has been calculating the tonnage index based on surveys from its membership since the 1970s.

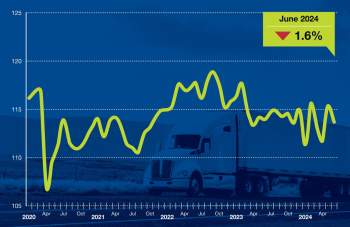

The American Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index decreased by 1.6% in June after increasing by 3% in May. In June, the index equalled 113.5 (2015=100), compared with 115.3 in May.

ATA Chief Economist Bob Costello said, “While giving back some of the gain from May, it appears that truck freight tonnage is slowly going in the right direction since hitting a recent low in January.”

“Despite June’s decline, the second quarter average was 0.2% above the first quarter and only 0.2% below the second quarter in 2023, which are good signs that truck freight might be finally turning the corner,” he added.

Compared with June 2023, the index decreased 0.4%. In May, the index was up 1% from a year earlier, which was the first year-on-year gain since February 2023.

The not seasonally adjusted index, which represents the change in tonnage actually hauled by the fleets before any seasonal adjustment, equalled 113.1 in June, 5.5% below May.

ATA’s For-Hire Truck Tonnage Index is dominated by contract freight as opposed to traditional spot market freight. In calculating the index, 100 represents 2015.

Trucking serves as a barometer of the US economy, representing 72.6% of tonnage carried by all modes of domestic freight transport, including manufactured and retail goods. Trucks hauled 11.46 billion tons of freight in 2022. Motor carriers collected USD 940.8 billion, or 80.7% of total revenue earned by all transport modes.

This is a preliminary figure and subject to change in the final report issued around the fifth day of each month. The report includes month-to-month and year-on-year results, relevant economic comparisons, and key financial indicators.

This story was originally published by ATA.