There are seven million buses and trucks on EU roads, enabling 330 billion passenger-kilometres for mobility services and 1.9 trillion tonne-kilometres for freight every year. Almost all are currently powered by fossil fuels, primarily diesel.

Fuel accounts for a significant part of the total cost of ownership (TCO) for any commercial bus or truck over a vehicle’s lifetime. From an operating company’s perspective, fuel represents around a third of annual costs.

Understanding fuel price dynamics is therefore crucial for operators to preserve business profitability and thin margins while maintaining transport capacity, service and quality for their clients.

The sector has also begun to transition towards carbon-neutral fuels, in line with the EU’s ambition to reach net-zero emissions by 2050. This will add more variables and uncertainty into the dynamics of how fuel prices evolve for the road transport sector in the short and long term.

This IRU Intelligence Briefing, which is updated annually, analyses fuel price dynamics in the EU, and per EU country, over time. It analyses prices for liquid fossil fuels such as diesel; additives such as AdBlue; gaseous fossil fuels such as compressed natural gas (CNG); and alternative fuels, including electricity and renewable biofuels.

What influences the cost of diesel? Where are fuel prices headed? What about AdBlue? Which EU countries consume the most diesel? Where is the EU getting its fuel from? How do fuel excise rates impact fuel prices? How do alternative fuels such as electricity and biofuels impact pricing dynamics?

Contents¶

1. Introduction

2. Context: Key EU road transport countries

3. Context: Bus and truck fleet composition

4. Diesel production and consumption

5. Diesel prices, geographical analysis, taxes and historical trends

6. AdBlue prices, geographical analysis, taxes and historical trends

7. CNG prices, geographical analysis, taxes and historical trends

8. Alternative fuels (HVO and electricity) pricing and availability at public stations

9. Short- and medium-term trend expectations

10. Key insights

1. Introduction ¶

Road transport operators have been using diesel vehicles for over a century. The diesel engine’s reliability, robustness and higher efficiency compared to gasoline engines, as well as high torque availability at slow speeds, make it ideal for medium and heavy-duty vehicles to meet the transport needs of people, businesses and communities.

Fuel constitutes one of the top three expenses for road transport operators, the other two being labour and equipment and infrastructure.

Road transport operators in the EU are committed to becoming carbon neutral by 2050, as per legislated targets. They will need both efficiency measures and alternative fuels to decarbonise over this period.

However, alternative fuels have yet to be proven at a large scale in terms of operational and economic feasibility for operators. Operators face a great deal of uncertainty in terms of technology and operational choices that must be made in the coming years. With fuel prices making up a significant share of vehicles’ TCO, how prices evolve in the market over time – across all types of drivetrain technologies – will be instrumental for operators’ ability to decarbonise and continue to meet transport demand.

This IRU Intelligence Briefing covers historical and potential future price trends for road diesel (hereafter “diesel”) and AdBlue. To contextualise fuel prices, the briefing first shows how energy demand depends on freight volumes and the type of powertrain. The analysis then turns to diesel price dynamics over time and across different EU countries.

The briefing also looks at CNG, as well as hydrotreated vegetable oil (HVO) and electricity as alternative fuels being used to decarbonise the EU’s road transport fleet. Finally, the briefing highlights future milestones which could impact fuel prices.

2. Context: Key EU road transport countries ¶

The optimal freight performance indicator to compare with fuel consumption is “tonne-kilometres”, as it accounts for the variation in payloads and distances. A geographical perspective is also important since EU fuel prices vary due to the diversity of fuel imports, the availability of refineries, production costs and tax differences.

Source: Eurostat (road_go_ta_tott) extracted on 2024-10-16

EU freight volumes grew over the last decade, peaking at 1.92 trillion tonne-kilometres in 2022. Nationally, freight volume metrics can be analysed from two perspectives. The first one is the national perspective, reflecting the volume of goods transported within a particular country or transited along national roads, regardless of the truck’s nationality. The second perspective looks at the distribution of freight volumes among national fleets, which can operate in different countries.

The first metric closely reflects the amount of fuel needed per country for road goods transport. The next chart uses this first perspective to illustrate the distribution of EU road freight volumes per country in 2022 (latest available data).

Source: Eurostat (road_tert_go) extracted on 2024-10-16

Germany has the greatest volume of road freight in the EU, due to its economic weight, central geographical location, advanced transport infrastructure, and manufacturing capacity. France and Spain are second and third, respectively. Therefore, these three countries are the biggest consumers of diesel for road freight.

However, this distribution of freight volumes between countries needs to be complemented by the distribution of freight volumes between national fleets. A vehicle registered in “country A” can operate in “country B” during international trips, cabotage or cross-trade operations. Additionally, today's diesel trucks have an average range of up to 2,000km, giving operators the flexibility to refuel where the price is the most competitive. The next chart shows the distribution of road freight volumes by national fleet.

Source: Eurostat (road_go_ta_tott) extracted on 2024-10-16

When looking at the distribution of freight volumes among fleets, the Polish fleet transports the greatest volume of goods in the EU. The German and Spanish are second and third, respectively. To better understand the reason behind such metrics, readers can view the European road freight trends and the size and economic landscape briefings.

The following graph depicts road passenger volume trends in passenger-kilometres. (The latest available data is for 2021, when the industry was still significantly affected by the Covid-19 pandemic.) When looking at the main countries in terms of volume, the same five EU countries lead in road passenger and goods transport, though in a slightly different order.

Source: European Commission (Statistical pocketbook 2023) extracted on 2024-10-16

3. Context: Bus and truck fleet composition ¶

The previous section showed that Poland, Germany, Spain, France and Italy transport the greatest volumes of people and goods in the EU; and, thus, use more energy for road transport than other EU countries. This section examines the type of fuel they use.

The EU fleet consists of 6.5 million trucks and 720,000 buses and coaches. The truck fleet is constantly growing. New trucks are added every year, while older trucks generally remain in use, finding new niche applications such as snow removal in small communities. On the other hand, the number of buses and coaches is more stable. Older buses have fewer potential use cases in the EU, making them more likely to be exported.

Source: Eurostat & IRU estimates (road_eqs_lorroa) extracted on 2024-10-16

Source: Eurostat (road_eqs_busveh) extracted on 2024-10-16

Medium and heavy-duty vehicles face many mechanical forces while being driven, such as aerodynamic drag. They need an internal unit, a powertrain, that generates mechanical energy to counteract these forces and move forward. Today, vehicle manufacturers offer several powertrain technologies:

Diesel powertrain: This form of mechanical energy is generated by the combustion of diesel, using a compression-ignited internal combustion engine.

Gas powertrain: This form of mechanical energy is generated by the combustion of methane, using a spark-ignited internal combustion engine. Methane can be stored in either compressed (CNG) or liquefied (LNG) form.

LPG powertrain: Liquefied petroleum gas (LPG) is used in either a spark combustion engine or a dual-fuel engine where it is mixed with diesel. LPG is mostly fitted by converting existing trucks.

Electric powertrain: This form of mechanical energy is generated by an electric engine converting electrical energy stored in a battery pack.

Hybrid powertrain: A powertrain combining two other powertrains (such as diesel and electric).

Hydrogen powertrain: This form of mechanical energy is generated by the conversion of hydrogen, either by a fuel cell combined with a battery pack and an electric engine (the most common form today) or an internal combustion engine.

Today, diesel powertrains are by far the most popular (99% of trucks and 94% of buses). Road transport operators have opted for diesel trucks since its introduction in 1923. Diesel engines have more torque than an equivalent gasoline engine, making them ideal for heavy vehicles transporting heavy loads. They also consume less fuel and tend to be more durable and reliable than other classic powertrains, as the engines are turning at lower speeds. These characteristics minimise vehicles’ total cost of ownership and preserve uptime.

However, diesel has a few drawbacks. The presence of tailpipe pollutants, despite significant reductions over the past decade (up to 98%), and its impact on carbon emissions are pushing lawmakers to guide truck manufacturers and road transport operators towards other fuels. The next chart depicts the number of alternative fuel buses and trucks available on the market. CNG and LNG trucks are gaining popularity over time, but electric vehicles are being adopted more rapidly. Despite the large number of LPG vehicles, the technology is slowly fading as this fuel is not seen as a decarbonisation solution and government subsidies, such as tax reductions, are being removed for this fuel.

Source: European Alternative Fuels Observatory extracted on 2024-10-16

In 2023, there were 98,000 trucks and buses running on alternative fuels in the EU. (Note that there are no newly registered LPG trucks as they are the result of aftermarket diesel engine conversions.) The five leading road transport countries– Germany, Poland, Spain, France and Italy – have 43,000 heavy-duty alternative fuel vehicles, which amounts to 80% of the alternative fuel vehicle market.

The next graphs, which showcase the distribution of alternative fuel vehicles for the top five countries, reveal significant differences in fleet composition. First, Poland's alternative fleet is mostly based on LPG powertrains. Lower prices at the pump than diesel, a strong refuelling infrastructure, and a retrofit network converting new vehicles have boosted the popularity of this technology in Poland. Italy, on the other hand, primarily relies on CNG and LNG trucks, due to lower prices at the pump, a strong refuelling infrastructure, and a local vehicle manufacturer with the largest range of natural gas-powered trucks and buses. The situation in Spain is very similar to Italy, whereas France has a large share of CNG vehicles. LNG vehicles started to be phased out of the French fleet in 2018, whereas electric vehicles rose in popularity in 2022, given its low electricity prices and national subsidies on purchasing. The German fleet includes a variety of alternative fuel vehicles. But electric buses and trucks make up more than half of Germany’s alternative vehicle fleet since 2023, due to government subsidies for the purchase of zero-emission vehicles (these purchase subsidies are no longer available).

Source: European Alternative Fuels Observatory extracted on 2024-10-16

4. Diesel production and consumption ¶

The previous section showed that diesel is the principal fuel used by road transport operators. To better understand diesel price dynamics in the next chapter, this chapter looks at its production and consumption.

Diesel is refined from crude oil. Crude oil is generally exported from oil-producing countries to countries with diesel refineries. In 2023, the biggest crude oil producers were the United States (15.6% share of daily barrel production), Russia (12.8%) and Saudi Arabia (11.6%).

Europe is a major importer of crude oil. Crude is extracted locally, but the region produces only 3.3% of the global share.

Source: Energy Institute (Statistical Review of World Energy 2023) extracted on 2024-10-16

All the above producers exported crude oil to the EU, at least until 2022, when sanctions were introduced limiting Russian fuel imports. The next chart shows from where the EU road transport sector is getting its crude oil.

Source: Eurostat (nrg_ti_oilm) extracted on 2024-10-16

Since 2019, Russian crude oil exports towards the EU have been decreasing, whereas US exports have been increasing. Brazilian exports, along with those from the US, have compensated for the lost Russian volume, surging from negligible amounts to a 3.8% share. Finally, the rise of Norwegian exports to the EU covered the remaining gap in 2023. OPEC countries accounted for about 33% of crude oil exports to the EU.

In 2023, there were 67 mainstream refineries turning crude oil imports into diesel in the EU. According to Concawe, Germany has the greatest number of refineries in the EU (11), followed by Italy (10) and Spain (8). Out of the 27 EU countries, 21 have local refineries. The countries without refineries are Cyprus, Estonia, Luxembourg, Malta and Slovenia. The next chart shows the national share of diesel production in the EU. Germany, Italy and the Netherlands are the top three producers.

Source: Eurostat (nrg_cb_oil) extracted on 2024-10-16

As seen in the first section, Germany, Poland, Spain, France and Italy are the countries with the largest share of road transport volumes. The next chart shows how the volume of road transport matches the consumption of diesel.

Source: Eurostat (nrg_cb_oil) extracted on 2024-10-16

When looking at the two previous figures, production and consumption locations do not match, intra-EU diesel trade is required. The Netherlands is the biggest exporter of diesel to other EU countries. The Port of Rotterdam is the busiest entry point for crude oil. France is the biggest importer of diesel, due to its high share of diesel cars and significant road transport volume.

Source: Eurostat

(nrg_cb_oil)

extracted on 2024-10-16

Finland is missing data for imports. Bulgaria, Estonia, Cyprus, Luxembourg have zero values for exports. EU average excludes previously mentioned countries.

The next graph illustrates the difference between local production and consumption of diesel for each EU country. Greece and the Netherlands export more than half of their diesel production. Belgium is not far behind. In contrast, Austria, France, Poland and Spain import a large quantity to meet their needs.

Given its size, the Spanish fleet is a major consumer of fuel. But Spain imports a relatively limited volume of diesel compared to its consumption. It also has a very limited refinery capacity. It rather manages to meet its diesel needs through inter-product transfers. Inter-product transfers are movements between petroleum products that occur due to the reclassification of products when the quality changes. For instance, aviation turbine fuel that has deteriorated or been spoiled may be reclassified as heating kerosene.

Source: Eurostat

(nrg_cb_oil)

extracted on 2024-10-16

Data is missing for Bulgaria. Refinery output is zero for Estonia, Cyprus, Latvia, Luxembourg, Malta, Slovenia.

Not only does the EU import crude oil to refine it, but it also imports petroleum products such as gasoline and diesel. The next chart shows the trendlines of crude oil and diesel volumes imported into the EU, alongside the total volume of oil and other petroleum products. In 2022, the EU imported 50% of the diesel it consumed (about 90 million tonnes).

Source: Eurostat

(nrg_cb_oil)

extracted on 2024-10-16

Diesel import is missing for Bulgaria and Finland. Crude oil import is missing for Estonia, Cyprus, Latvia, Luxembourg, Malta, Slovenia, Bulgaria.

The main exporters of diesel to the EU are the same as for crude oil (mainly Russia, the US and Saudi Arabia). However, in recent years, diesel imports have stagnated, despite an increase in crude oil imports. This suggests that the EU is focusing on its own refinery capacity. Furthermore, in 2022, due to the war in Ukraine and sanctions against Russia, diesel imports from non-EU countries fell by 60%. This points to a growing shift towards energy independence in the EU.

Source: Eurostat (nrg_ti_oilm) extracted on 2024-10-16

5. Diesel prices, geographical analysis, taxes and historical trends ¶

Here is a recap of some of the key information highlighted in the previous sections to better understand diesel price dynamics:

- Diesel is the most used fuel in commercial road transport

- Germany, Poland, Spain, France and Italy are the biggest consumers of diesel

- The EU gets most of its diesel from the refinement of crude oil in European countries

- Some EU countries rely on other EU countries to compensate for the deficit between local production and consumption

- Diesel also needs to be imported from outside the EU to meet demand

- Major exporters of crude oil and diesel to the EU are OPEC countries (33%), followed by the US and Norway

As shown next, diesel prices at the pump are the accumulation of costs and different profits generated from the handling, refining, transport and distribution of crude oil, including taxes. All these components will now be analysed in detail.

Crude oil prices are generally given in monetary value per barrel, with one barrel having a volume of approximately 160 litres. From a single barrel, a refinery extracts mostly gasoline (about 43%) and diesel and heating oil (about 23% each). Therefore, a barrel of crude oil produces around 40 litres of diesel.

The next chart illustrates the evolution of crude oil prices over the last decade. In 2013, crude oil prices were high (USD 116 per barrel), before falling due to increased production in the US. Crude oil prices hit their lowest point during the pandemic, due to low demand, before jumping to USD 117 per barrel. Since then, prices have been slowly decreasing, with a small bump at the end of 2023 due to surging demand worldwide and instability in the Red Sea.

Source: Eurostat

(nrg_ti_coifpm)

extracted on 2024-10-16

Data is missing for Poland (from 2020 onwards due to confidentiality).

Diesel prices include the cost of raw materials, refining, distribution and excise taxes. The raw material component can be estimated from crude oil prices, as one barrel generates an average of 40 litres of diesel, accounting for about 23% of a barrel's value (assuming the price value of a barrel is distributed equally among its different components based on their volume proportion). Using this method, the following graph illustrates the price of diesel’s raw material components from 2012 to 2024 based on the above crude oil prices. In the EU, diesel’s raw material components make up about 28% of the final price at the pump.

Source: IRU estimates

Refinery and distribution costs add to this raw material component. Using French data as an example, refineries add another EUR 0.10 per litre (about 6% of the final price), and distribution adds around EUR 0.24 per litre (about 14% of the final price). The cost of the refinery component experienced a sharp increase in 2022, when the war in Ukraine created tensions between fuel supply and demand. In 2023, there was a slight decrease from 2022, but the levels remained very high compared to the pre-war period. The distribution cost has increased by four since 2015, with no signs of decreasing. This component also includes environmental taxes, adding to an already challenging context for delivering fuel to fuel stations (driver shortages, lack of transport capacity, etc).

Source: French Ministère de la transition écologique et de la cohesion des territoires extracted on 2024-10-16

Excise taxes, the last component of diesel prices, vary from country to country. (Excise taxes are indirect taxes on the sale or use of alcohol, tobacco and energy. They are calculated based on the quantity of fuel purchased, not their value. The entire revenue generated from excise taxes goes to the country where they are paid.)

EU legislation sets harmonised minimum rates harmonised minimum rates (0.33€/L). The Energy Taxation Directive establishes the minimum excise duty rates that EU countries must apply to fuel for transport services and electricity. But EU countries are free to apply excise duty rates above these minima, according to their own national needs. The following chart provides an overview of the current diesel excise rates by country.

Source: European Commission (Taxes in Europe database v4) extracted on 2024-10-16

These excise rates range between EUR 0.33 per litre (08/2024) in Bulgaria to EUR 0.62 per litre in Italy (08/2024). Finally, a value added tax (VAT) is added, ranging from 17% In Luxembourg to 27% in Hungary. The next graph breaks down diesel taxes by country. Other indirect costs include, national taxes on petroleum products and strategic stockholding fees. Indirect costs are significant in countries such as Portugal, Austria and Germany.

Source: EEA (Weekly oil bulletin) extracted on 2024-10-16

Having unpacked all the components determining the price of diesel, the next graph shows its final evolution over the past five years, influenced by crude oil price dynamics. The data shown here is the average price paid by transport operators, factoring in the amount of fuel purchased per country and its local prices, averaged then at a regional scale. EU countries could modify the tax components to avoid strong increases, such as in 2022 when there was a surge in crude oil prices due to the economic fallout of the war in Ukraine.

Source: EEA (Weekly oil bulletin & UNFCCC) extracted on 2024-10-16

When comparing the price of diesel among the five leading EU road transport countries, Poland has the lowest price, due to low taxes and lower crude oil prices, followed by Spain, Germany, France and Italy. Interestingly, national fleets conducting 90% or more of their freight operations internationally have some of the lowest national diesel prices in the EU. For example, Lithuania, Luxembourg and Slovenia have prices below those in Poland, giving them a competitive advantage.

Based on xavvy extracted on 2024-10-16

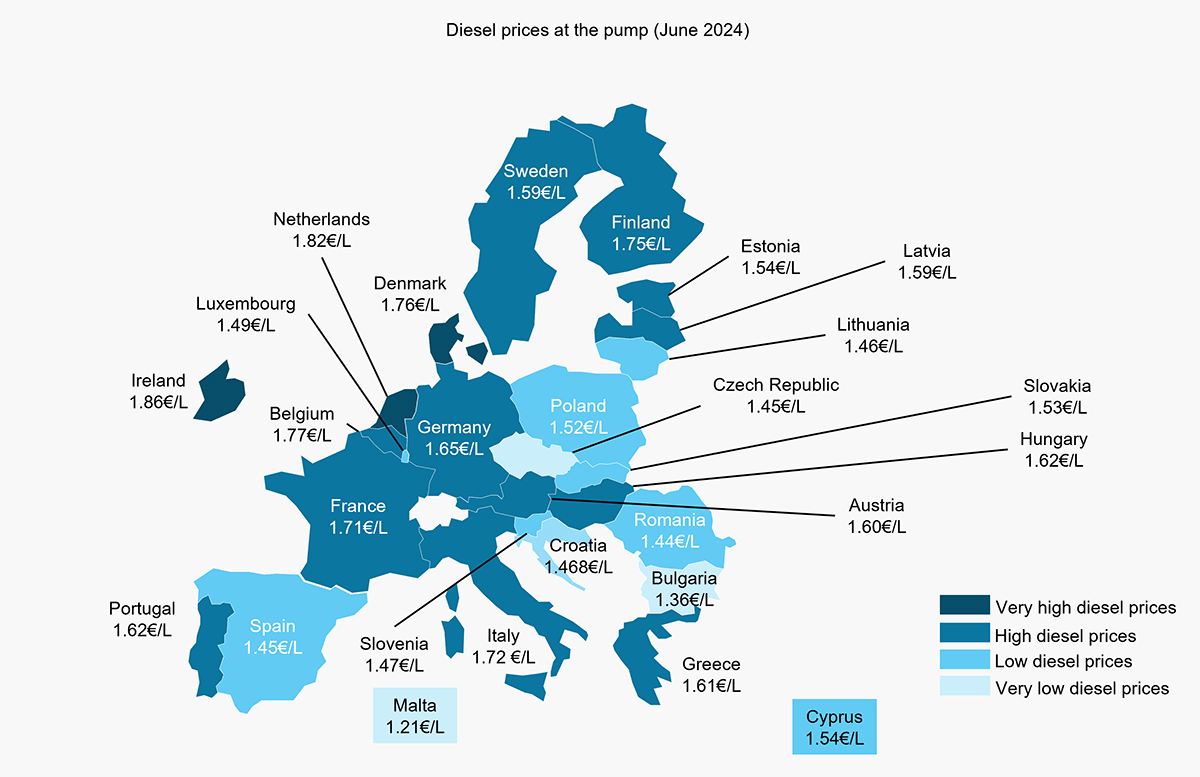

The map below offers an overview of diesel price disparities within the EU. At the time of publication, diesel prices ranged from EUR 1.36 per litre (VAT included) in Bulgaria to EUR 1.86 per litre (VAT included) in Ireland.

Based on xavvy extracted on 2024-10-16

6. AdBlue prices, geographical analysis, taxes and historical trends ¶

In today's world, diesel alone cannot be used in an internal combustion engine. Several generations of exhaust regulations have reduced the maximum allowable quantity of pollutants emitted from truck and bus exhaust pipes. With EURO VI, these regulations apply to all new trucks sold in the EU, limiting vehicle emissions of carbon monoxide, hydrocarbons, particulate matters, and nitrogen oxides.

The selective catalyst reduction (SCR) system addresses the release of nitrogen oxides resulting from the chemical reaction between nitrogen and oxygen at high combustion temperatures. SCR injects a solution called AdBlue into the exhaust system to transform nitrogen oxides into nitrogen and water molecules. The consumption of AdBlue is proportional to the consumption of diesel, with AdBlue consumption making up about 5% of diesel consumption by volume.

AdBlue is made by mixing urea with demineralised water. Demineralised water does not contain mineral salts. The water is boiled and the resulting vapor is condensed. The production of urea is more complex. To produce urea, ammonia and carbon dioxide are combined via the Haber-Bosch process. Generally, the same factory produces ammonia and carbon dioxide. Ammonia is produced from hydrogen, which derives from natural gas. Transforming natural gas into hydrogen also creates carbon dioxide, which is collected and reused to produce urea. Urea takes the form of granules or liquid, which is then mixed with demineralised water to make AdBlue.

Since AdBlue is mostly produced from natural gas, its price is closely tied to natural gas prices, which soared at the start of the war in Ukraine. The distribution cost of AdBlue is also very high, as raw materials are mostly made of demineralised water. Some producers indicate that it represents more than 50% of the final product cost (pre-2022).

Using the next charts to examine the average price of AdBlue at the pump, disparities among EU countries begin to emerge, with no clear trends in price dynamics. Note that AdBlue is also sold in small containers (such as 5-litre canisters) at much higher prices (over EUR 3 per litre).

Based on xavvy extracted on 2024-10-16

7. CNG prices, geographical analysis, taxes and historical trends ¶

As seen in the second section, compressed natural gas (CNG) is the second most used alternative fuel choice among road transport operators in the EU. With engine power and torque levels comparable to diesel engines since 2013/2014, CNG-fuelled vehicles have been growing in popularity.

Although there was a slowdown in CNG-fuelled vehicle registrations in 2021 and 2022, it soared back in 2023, regaining momentum comparable to electric trucks and closing the gap with electric buses. The sharp increase in CNG trucks in 2023 could be associated with the implementation of the Eurovignette Directive in countries like Germany and Austria, which applied a lower toll rate to CNG vehicles than to diesel ones.

CNG is a derivative of natural gas, stored on board in cylinders at a pressure between 200 and 250 bars. CNG can be distributed via pipelines or dedicated trucks. The next chart shows a downward trend in import levels for CNG in recent years (in terms of energy content), as mild winters and geopolitical tensions in Europe have lowered consumption levels.

Source: Eurostat (nrg_ti_gas) extracted on 2024-10-16

The EU’s production of natural gas fell drastically over the last decade, with the Netherland’s production level going from 2.5 million terajoules in 2014 to 0.4 million terajoules in 2023 (-84%). Other large producers, such as Denmark, Germany and Italy, also saw their local production fall sharply. The war in Ukraine has limited Russian natural gas imports (Russia exported natural gas to only nine EU countries in 2023).

Source: Eurostat (nrg_ti_gas) extracted on 2024-10-16

Just like diesel, natural gas prices consist of raw material components, distribution costs, excise taxes and VAT. The next graph shows the impact of 2022 on the raw material component at the EU level, with prices jumping from previous levels.

Source: Eurostat (nrg_pc_203_c) extracted on 2024-10-16

At the national level, CNG price dynamics are highly volatile. In 2019, natural gas was the most expensive in Greece, while in 2023, it was Sweden. It was the cheapest in Lithuania in 2019 and in Spain in 2023. (Note: these prices are for natural gas for a given country, not at the pump.)

The next figure illustrates the final prices for natural gas, including distribution costs and taxes. The network cost covers transmission and distribution tariffs, transmission and distribution losses, network costs, after-sale service costs, system service costs, and meter rental and metering costs.

Source: Eurostat

(nrg_pc_203_c)

extracted on 2024-10-16

Energy and supply is a sum of ”energy and supply” and ”other” components.

For the above EU countries, total taxes range from -2% (Luxembourg, incentivising natural gas consumption, included in energy and supply in the previous figure) to 38% (Sweden) of the final price for natural gas. These taxes include VAT (the largest component of the final tax), a renewable tax, a capacity tax and an environmental tax.

The renewable tax, applied in Belgium, Spain, Italy, Poland and Slovenia, covers charges related to the promotion of renewable energy sources, energy efficiency, combined heat and power generation. In 2023, Slovenia had the highest renewable tax rate at 1.9% of the final price.

The capacity tax covers charges related to strategic stockpiles, capacity payments and energy security. It also includes taxes on natural gas distribution, stranded costs and levies for financing energy regulatory authorities or market and system operators. In 2023, Germany had the highest capacity tax rate (5.2% of the final price).

Finally, the environmental tax applied in most EU countries covers charges related to air quality and other environmental purposes, as well as taxes on CO2 and other greenhouse gas emissions. This component includes excise duties. Poland had the lowest environmental tax rate in 2023 (0.3%), while Finland had the highest (18.1%).

CNG prices at the pump vary from country to country. Among the five leading EU road transport countries, CNG is generally the cheapest in Spain, followed closely by Italy, which explains the popularity of CNG buses and trucks in both countries.

Based on xavvy extracted on 2024-10-16

After soaring in 2022, CNG prices have been recovering since 2023, returning closer to their pre-2022 levels. CNG prices are facing an upward trend, which will also be influenced by future taxation linked to the EU emissions trading system (ETS2) (see section 8).

8. Alternative fuels (HVO and electricity) pricing and availability at public stations ¶

The EU’s road transport sector is gearing up to become carbon neutral by 2050. By combining energy systems modelling and road transport metrics, the IRU Green Compact study on Europe found that the most pragmatic way to achieve this goal is by leveraging a dual approach: improving efficiency measures and implementing alternative fuels.

Among the different alternative fuel options available for road transport, two are gaining momentum in the EU: hydrotreated vegetable oil (HVO) and electricity.

HVO, also referred to as renewable diesel, is a biofuel made from waste products such as cooking oil, animal fat, tallow, fish oils and technical corn oil. It is considered an alternative fuel because, on a well-to-wheel accounting basis, it emits about 0.52 kgCO2 per litre, on average, in the EU, which is 85% less than diesel.

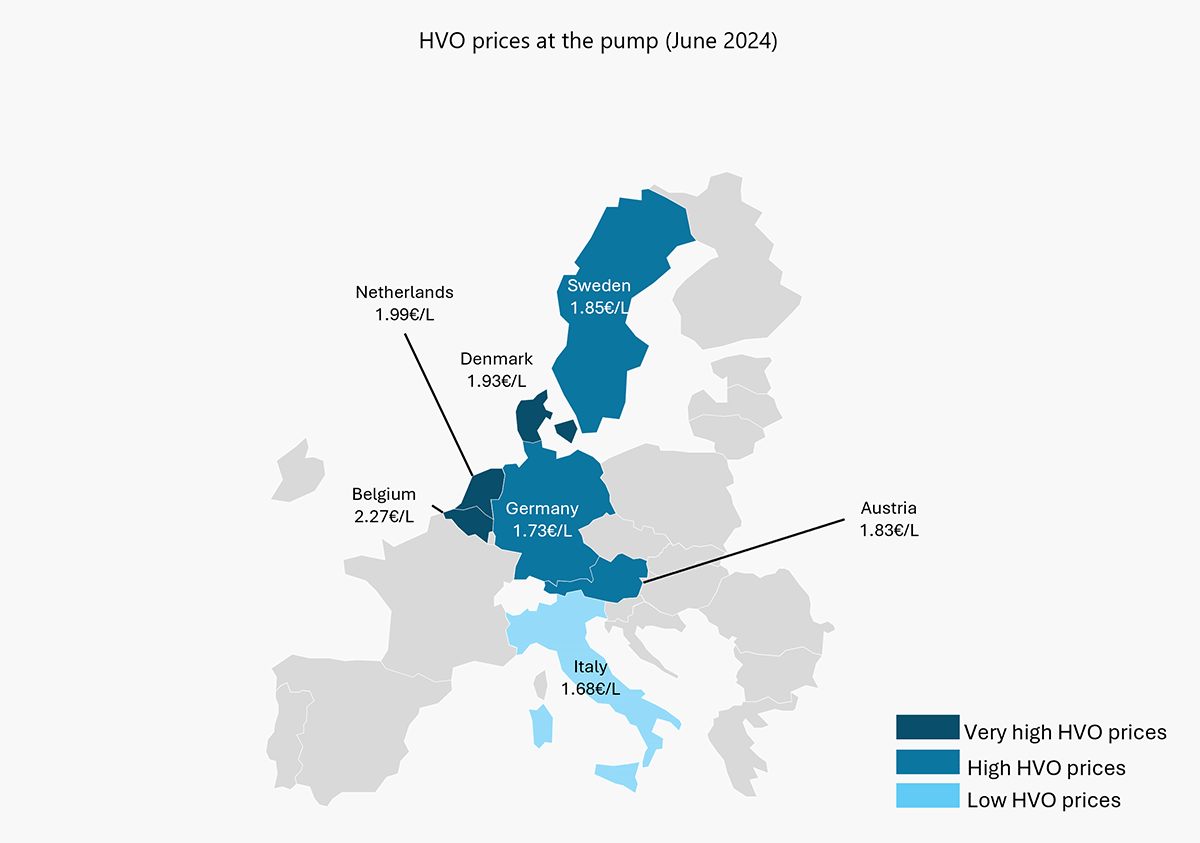

The advantages of HVO, compared with diesel, include less tailpipe pollutants (better trade-off between particulate matters and nitrogen oxides) and compatibility with a modern diesel engine. However, its disadvantages include a higher price and more limited availability. Not all EU countries allow the distribution of HVO at public refuelling stations. (Cyprus, Greece, Hungary, Latvia, Lithuania, Luxembourg, Malta, Portugal and Slovenia do not have public HVO refuelling stations.) There are also disparities in the density of HVO refuelling stations within the EU. The Netherlands has the greatest density, while France and Romania have the lowest density of HVO refuelling stations, with five and two public stations distributing HVO, respectively. However, the situation is evolving rapidly, as the number of stations tripled between March and July 2024.

The next figure shows the price dynamic for HVO at the pump. In general, HVO is between EUR 0.04 per litre to EUR 0.50 per litre more expensive than diesel, except in Italy where HVO is EUR 0.04 per litre cheaper due to government subsidies.

Based on xavvy extracted on 2024-10-16

Electric buses and trucks are the other type of popular alternative fuel vehicles. Vehicle manufacturers are increasing their electric offerings. New electric trucks offer a range of 500km at 40 tonnes of gross combined weight. The level of carbon emissions reduction depends on the electricity's carbon intensity, which varies significantly within the EU. Electric trucks cost two to three times more than diesel trucks, making the price of electricity for charging crucial for a competitive total cost of ownership.

The following electricity prices are provided for a consumption band between 2,000 and 19,999MWh. For comparison, a fleet of 25 electric trucks travelling 100,000km per year would need about 6,000MWh of energy.

Wholesale electricity prices, in both the EU and leading EU road transport countries, started increasing in 2021, spiking in 2022, as shown below. The Italian market was the hardest hit in 2022, but it recovered more quickly, along with Spain, compared to other EU countries. France surpassed the EU average value in 2023, due to maintenance infrastructure issues and lower hydropower levels.

Source: Eurostat (nrg_pc_205) extracted on 2024-10-16

When we include taxes, the picture changes for Germany, which now has one of the highest electricity prices among the five leading EU road transport countries, surpassing the EU average. Poland also exceeded the EU average in 2023, with only Spain offering prices below the EU average to non-household consumers.

Source: Eurostat (nrg_pc_205) extracted on 2024-10-16

Looking at the broader perspective within the EU, electricity prices vary significantly. Hungary has the highest price per kilowatt-hour, while Sweden has the lowest. Malta has the highest network cost, while Cyprus has the lowest.

Regarding taxes, Poland has the highest tax rate (47% of the final price), which is close to its diesel taxation level. Portugal has negative tax rates due to its negative renewable and capacity tax rates (removed from “energy and supply” in the next figure).

Source: Eurostat (nrg_pc_205_c) extracted on 2024-10-16

It is difficult to determine the price of electricity at charging stations, as it depends on where operators charge their vehicles (depot charging or public charging), the charging power, and the contract negotiated with grid operators. Costs range from EUR 0.2 per kilowatt-hour for depot charging to EUR 0.55 per kilowatt-hour plus a transaction fee for powerful public chargers (VAT included).

9. Short- and medium-term trend expectations ¶

Energy prices are highly dependent on consumer demand, political decisions and the geopolitical situation. All three are quite difficult to forecast, as consumer demand depends on the economic situation as well as more unpredictable indicators such as weather conditions and the type of winter. Political decisions and geopolitical tensions are always evolving. Their influence on energy prices are difficult to grasp and anticipate.

The countries and regions – the US, Russia, the Middle East and Venezuela – exporting crude oil and diesel to the EU are facing various uncertainties:

- US: The 2024 presidential election could impact crude oil production and prices.

- Russia: The current situation in Ukraine continues to block the export of crude oil towards the EU and limits natural gas imports. The latest developments are creating volatility on the global market.

- Middle East: The ongoing conflicts and tensions in the Middle East are impacting crude oil prices.

- Venezuela: Uncertainties persist following the 2024 election.

The US Energy Information Administration (EIA) monitors Brent crude oil prices and natural gas spot prices in the US. In their short-term energy outlook, the EIA also provides forecasts for both metrics, giving European consumers an idea of fuel price dynamics. In their latest forecast, EIA predicted an average of USD 89 per barrel for the second half of 2024, up from USD 84 per barrel in the first half (a 6% increase). Another increase is projected for 2025, with Brent reaching USD 91 per barrel during the first half of 2025 (an 8% year-on-year increase). For natural gas, the agency expects a year-on-year price increase of 30% in 2025. The market might experience tensions between demand, production and storage due to low consumption during the last mild winter.

The European Commission has recently implemented several regulations and directives to guide industries towards achieving carbon neutrality by 2050: CO2 standards for new vehicles, the Eurovignette Directive for toll taxes, CountEmissionsEU for CO2 reporting, and Euro 7 for pollutant emissions. Most of these regulations will impact the total cost of vehicle ownership, but they will not directly affect fuel prices at the pump. However, with the integration of road transport (private cars and commercial vehicles) into ETS2 by 2027, an increase in fossil fuel prices based on their carbon content is anticipated. In the long run, this also means less demand for diesel powertrains.

Based on the tank-to-wheel approach, burning one litre of diesel emits 2.62kg of CO2, while one kilogram of natural gas, either LNG or CNG, emits 2.31kg of CO2. Integrating road transport into ETS2 means that the carbon content of fossil fuels used by trucks and buses will have a price set by a carbon exchange market, starting at a minimum of EUR 45 per tonne of CO2, with no maximum value. The next chart shows the link between carbon pricing and fossil fuel taxation for diesel and natural gas, excluding additional value-added taxes that EU countries might apply. Note that AdBlue will also be included in ETS2 in the future.

Source: IRU estimates

10. Key insights ¶

This IRU Intelligence Briefing examined how the sector’s energy demand depends on freight volumes and different powertrains. It outlined the main energy production and trade patterns across EU countries and their main trading partners. It also focused on price trends, tax components and geographical analyses of HVO, diesel, AdBlue and CNG across the EU. The briefing concluded with a breakdown of alternative fuels pricing, availability and future policies.

Total EU road freight has been rising over the past decade, reaching 1.92 trillion tonne-kilometres in 2022, led by Poland, Germany, Spain, France and Italy. A closer look at national fleets shows that Poland is a major freight mover in the EU, highlighting the impact of cross-border operations and fuel price optimisation.

Buses also contribute significantly to fuel consumption. EU buses and coaches completed 330 billion passenger-kilometres in 2021, when the industry was still dealing with Covid-19. Germany, France, Spain, Poland and Italy lead in both freight and passenger transport, underlining their importance to the EU's energy consumption landscape.

The EU's road transport sector includes 6.5 million trucks and 720,000 buses. Diesel powertrains currently account for 99% of trucks and 94% of buses. However, the transition to net-zero emissions has sparked interest in alternative powertrains such as CNG, LNG and electric. In 2023, about 98,000 vehicles used alternatives to diesel, with Poland, Italy and Spain advancing significantly in the adoption of LPG, CNG and LNG, respectively. Germany leads in electric vehicle integration, driven by subsidies and a focus on reducing carbon emissions.

The EU heavily relies on crude oil imports for diesel production, particularly from the US, Saudi Arabia and Norway. In 2023, the EU produced 60% of its diesel needs locally, signalling a shift towards energy independence. Germany, Italy and the Netherlands are the top diesel producers, while countries such as Austria, France, Poland and Spain rely heavily on imports to meet local demand.

EU diesel prices are influenced by crude oil costs, refining costs, distribution, and taxes. The raw components account for only 28% of the final price at the pump. Diesel prices reflect the global oil market, with significant fluctuations observed over the past decade, peaking due to geopolitical tensions like the war in Ukraine. Taxes, including excise duties and VAT, make up a substantial portion of diesel prices, varying widely across the EU. The average EU diesel price was EUR 1.81 per litre in 2022, reflecting a 30% increase over the past decade. In 2024, diesel prices ranged from EUR 1.36 per litre in Bulgaria to EUR 1.86 per litre in Ireland. Countries with lower diesel prices like Poland have a competitive edge in international road freight.

AdBlue, which is essential for reducing nitrogen oxide emissions in diesel engines, is a significant cost factor for operators. Its price is closely linked to natural gas, as urea, a key component, is derived from ammonia produced from natural gas. The impact of the war in Ukraine on natural gas prices has led to AdBlue price volatility. Variations in AdBlue prices across EU countries reflect differences in production, distribution and market conditions. The average EU AdBlue price increased from EUR 0.5 per litre to EUR 1.15 per litre between 2021 and 2023. That is a 130% price increase.

CNG is gaining momentum as an alternative fuel for road transport, offering performance levels comparable to diesel engines since 2013/2014. CNG saw a resurgence in 2023, driven by favourable toll rates under the Eurovignette Directive in countries like Germany and Austria, which offer lower toll rates for CNG powertrains.

Local natural gas production in the EU has been declining over the last decade, highlighting the EU’s reliance on imports. CNG prices, influenced by raw material costs, distribution and taxes, show significant national disparities. In 2023, Spain had the lowest CNG price, while Sweden had the highest due to higher taxes. The geopolitical landscape, particularly the war in Ukraine, has impacted natural gas imports and affected CNG pricing. Nevertheless, CNG prices are returning to pre-2022 levels.

By combining energy systems modelling and road transport metrics, the IRU Green Compact research on Europe showed that the most pragmatic way to decarbonise is by leveraging a dual approach: improving efficiency measures and deploying alternative fuels. The EU's path to carbon neutrality emphasises the adoption of alternative fuels like HVO and electricity. HVO significantly reduces carbon emissions compared to diesel (84% reduction on well-to-wheel approach) but faces challenges in availability and cost. Electric vehicles, although expensive, will become increasingly viable through improvements in range and infrastructure. Electricity prices for charging electric fleets vary among EU countries, with significant differences in tax rates and network costs. Poland has the highest tax rate, while Portugal subsidises electricity.

Energy prices are influenced by many factors, including consumer demand, political decisions and geopolitical events, making it difficult to forecast future prices. Key geopolitical factors include the 2024 US presidential election, the war in Ukraine, conflicts in the Middle East and Venezuela's political climate. The US Energy Information Administration projects that Brent crude oil prices will reach 91 USD per barrel by 2025. It also forecasts a 40% increase in natural gas prices. EU regulations such as CO2 standards, the Eurovignette Directive and ETS2 will impact vehicle ownership costs and fossil fuel prices. As the EU navigates these complex dynamics, operators need to stay informed to adapt strategies effectively.

More information and insights available on the IRU Intelligence Platform.